Payment Processing Update

First Quarter 2026

Lockbox - Still Thriving, Still Delivering Value

After 9 decades as a B2B payment and deposit product, how does lockbox and its companion integrated receivables continue to deliver value to financial institutions?

By evolving as the payment ecosystem evolves. Let’s start by agreeing on the key strengths of a lockbox solution. They include experience and expertise with:

1. Payment processes & Business rules

2. Best practices & controls

3. A/R systems and interfaces

4. Managing payment exceptions

5. Data normalization & reformatting

6. Data delivery & connectivity

None of which are specific to a check payment!

Despite declining check volume, the payment landscape will continue to support the coexistence of checks and electronic payment channels. What links these two payment streams? The answer is the need for complete and accurate remittance data. Specifically, the three key data elements needed to complete the order-to-post cycle: (1) Who paid; (2) How much was paid; (3) What was the payment for.

Accessible remittance data is the new imperative in payment processing today. It can produce value from the payment experience. Money (think deposits) is fungible, data is not. Data carries a fixed value that each A/R system requires to post a payment. This process presents a challenge as there are hundreds of accounting systems with specific data requirements. From generic small business solutions like QuickBooks, to enterprise-class systems such as Oracle Financials to dozens of industry-specific systems (think EPIC/Healthcare or HTE/Public Sector).

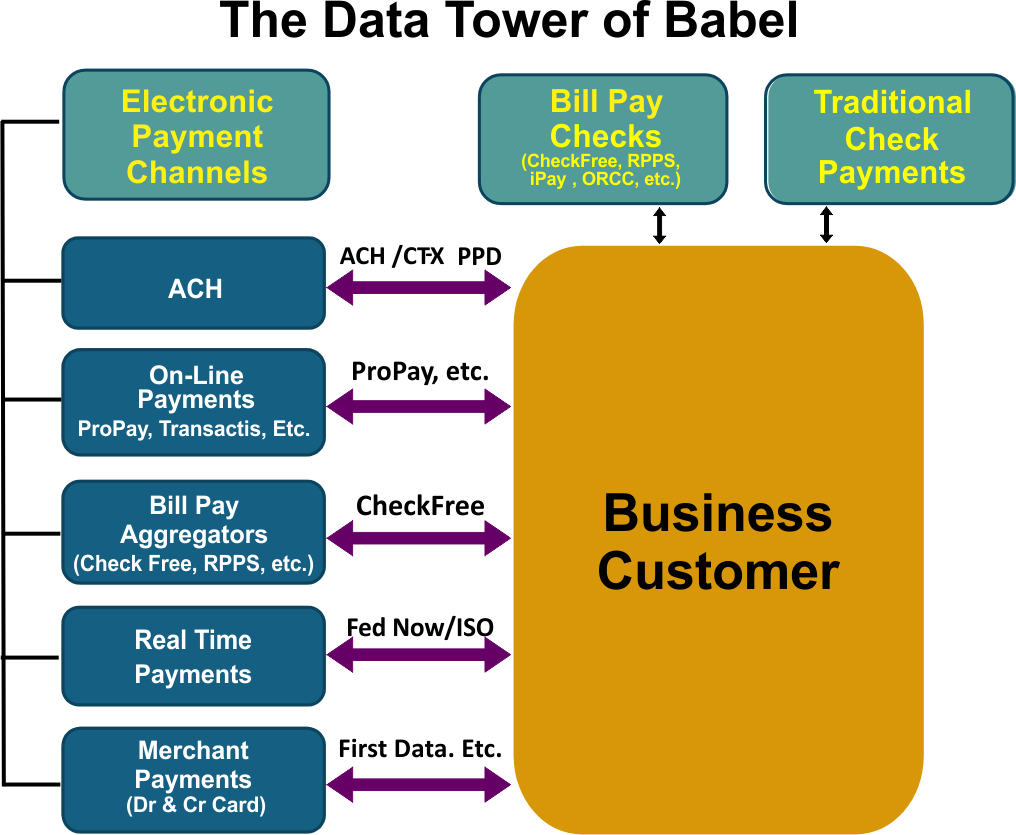

Facing the Data “Tower of Babel”

Businesses, especially the SMB market, face a data “Tower of Babel” in trying to automate an efficient auto-posting workflow from multiple payment sources as illustrated in graphic.

There are three drivers that dominate the payment ecosystem: Choice, Velocity and Data Delivery. Lockbox is the only bank-centric product that understands the money (deposit) and data (remittance) elements of B2B payments. It is well positioned to advance these industry drivers despite its check legacy.

Lets break down each driver as it relates to lockbox:

Choice: Check payments is one of dozens of payment “choices”. But despite declining check volume, 90% of businesses use checks for some/all of their payment practices and 70+% do not have any plans to reduce check usage in 2026 (2025 AFP report). Lockbox is still the banking industry standard for processing B2B check payments.

Velocity: How quickly money (deposits) moves through the payment process. Today this part of the order-to-post cycle has been solved. Faster payment options, RTE, same day ACH and others all get the money deposited faster and in some cases near real time. Check deposits routinely result in same day availability due to image exchange. Remittance data does not flow so efficiently.

Data Delivery: THIS process is what lockbox excels at and what produces significant revenue opportunities for banks and A/R processing efficiency for the B2B client.

The Ideal “Data Bridge”

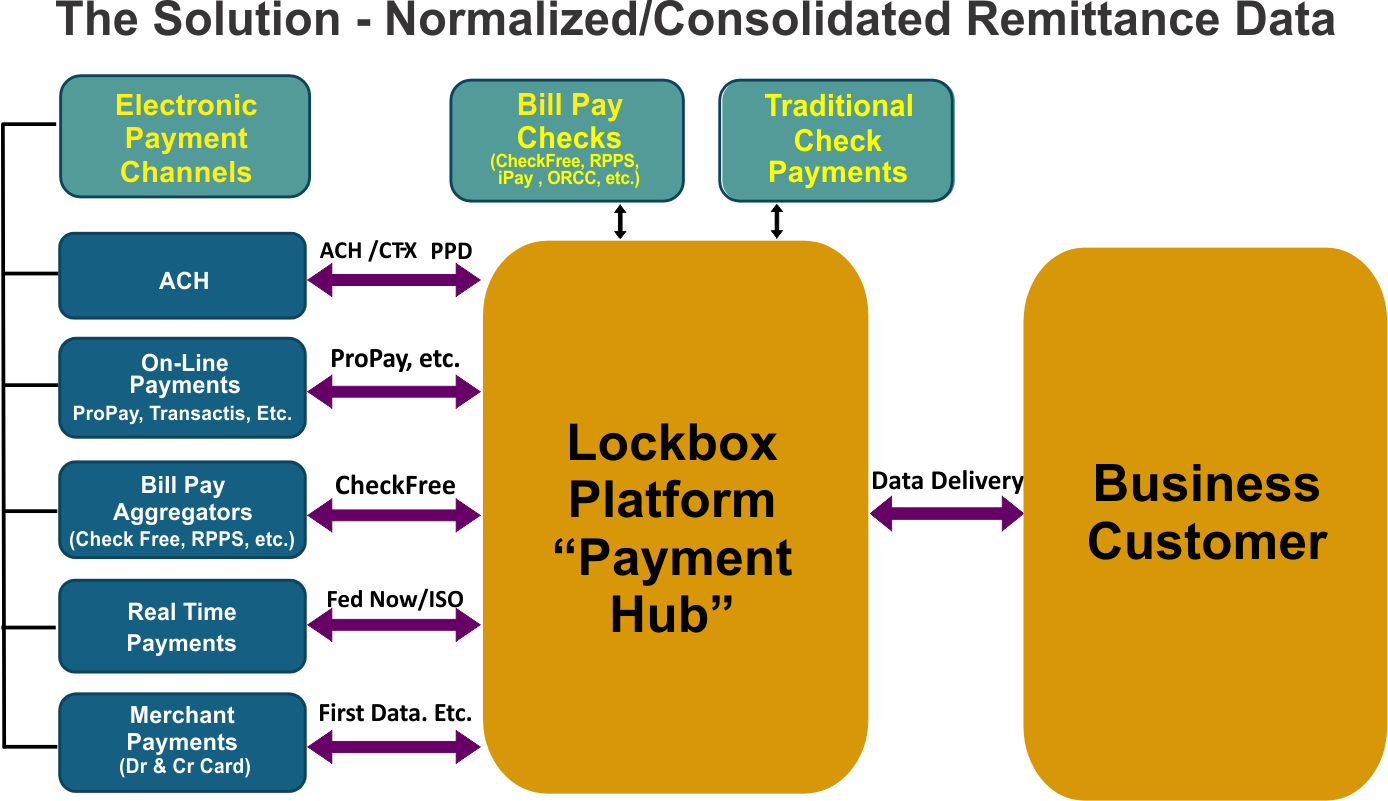

Lockbox is the ideal “data bridge” between check and electronic payment sources. It can provide the technology, processes and data delivery to normalize information from multiple payment streams and convert the “tower of babel” mess to an A/R-specific data format for improved auto-posting of all payments types.

And lockbox can do this across the universe of the bank’s B2B client base regardless of the accounting systems utilized resulting in a powerful payment “Hub” for consolidated payment data access (reports, data files & archive).

Banks still “own” the deposit systems in the U.S.

Remittance DATA is the real value in the payment ecosystem. Banks need to “own” as much of this portion of the payment transaction as possible. And it can be monetized to produce benefits for the bank and business client including : (1) Business account, fee income & deposit growth;

(2) Support a community bank’s goal in advancing its “High Touch/High Tech” image; (3) Strengthen high value treasury client relationships.

TMR has over 30 years of remittance automation experience. The TMR CITATION™ i-Remit solution and companion integrated receivables provides a comprehensive private label deposit and data delivery solution for community and regional banks. It can be a key part of your treasury product strategy and an important element to your core payment franchise operation.

Here’s wishing you a successful start to the new year!

Let’s start a conversation about how lockbox will add value to your institution’s business plans and goals. Contact me anytime at 407-830-2432 or mreynolds@tmrsolutions.com.

Mike is a senior sales/management professional. His in-depth knowledge of payment processing markets, lockbox operations, e-payment solutions and integrated receivables reporting is highly regarded in the banking industry.